An economic evaluation is a vital step prior to putting on see if you'll have the ability to pay for living costs, insurance and also taxes after taking this type of funding. In the case of HECM home mortgages, your home has to comply with HUD's minimum home standards to certify. Moreover, you may be needed to make use of several of the loan profits for home renovations if your residence doesn't meet HUD standards. For single-purpose reverse mortgages, the money's objective needs to be examined and approved by the loaning agency. Additionally, reverse mortgages have a tendency to have greater rates of interest than standard mortgages. Given that an HECM for Purchase entails getting a brand-new primary home, the down payment on the brand-new home goes through specific laws.

- If there's an equilibrium from ahome equity loanorhome equity credit line, for example, or tax obligation liens or judgments, those will certainly have to be paid with the reverse home loan earnings first.

- However the only method to prove whether the rate of interest is deductible is to maintain documents that show exactly just how you utilized funds from a reverse home mortgage.

- Otherwise till after, he will be called for to likewise go through a great deal of the documents and also the therapy.

Furthermore, they would get an ensured development rate on their extra line of credit funds. Surefire repayment forever (known as a "period payment") which lasts if you live in your home. You can make a repayment at any time, up to and also consisting of repayment completely, scot-free.

There's likewise the opportunity that you may not get a reverse mortgage yet are in need of assistance. A reverse home mortgage could also affect the ownership of your house down the line. If you live with a person as well as get a reverse home mortgage that you or they can not pay back, they might lose their living setups in the event of a repossession. When you secure a reverse home loan it reduces the value of your house equity since you're borrowing versus what you currently have. For example, if you have $100K of your house and you make use of $50K in a reverse home mortgage, you now only own $50K of your house.

What Are The Needs For A Reverse Home Loan, And Exactly How Can You Begin?

It is a long-term form of loaning that Moneyhub claims may charge different costs and also can make it a pricey way of funding. You must always look for independent economic advice prior to committing to a big financial choice. No mortgage settlement indicates no DTI proportion requirements, which are a significant consider getting a regular home mortgage.

You Wont Pay Taxes On The Money You Get

Don't fail to remember that although a reverse mortgage can give you with a credit line, you are still accountable of various other living expenses like tax obligations as well as insurance. Ask your lending institution what payment alternatives they offer for a reverse mortgage. Prior to https://www.businesswire.com/news/home/20200115005652/en/Wesley-Financial-Group-Founder-Issues-New-Year%E2%80%99s obtaining a reverse home loan, you should first repay and close any type of superior financings or credit lines that are secured by your home. These can include a mortgage as well as a house equity credit line. You can make use of the cash you receive from a reverse mortgage to do this. A reverse home mortgage is a funding that enables you to get money from your home equity without having to sell your residence.

Do This To Avoid Repossession From A Reverse Mortgage

Before you make a decision to obtain a reverse mortgage, ensure you think about the advantages and disadvantages thoroughly. When you die, your estate has to pay back the whole quantity owing. If numerous individuals own the home, the finance https://www.businesswire.com/news/home/20191008005127/en/Wesley-Financial-Group-Relieves-375-Consumers-6.7 has to be repaid when the last one passes away or sells your home. The only way the lender can ever before take title to the home is the same method just like a conventional or ahead car loan, if you or your heirs deed the home to them, or they foreclose on the loan. As I stated earlier, the loan provider has none to play in this process. They are a lienholder as well as it is up to the existing proprietors and also any kind of member of the family as well as the courts to determine who will have the residential or commercial property after the passing away of the owner.

In your case, you might choose the line of credit history option, draw the quantity you desire, and also the other funds would stay in the line, readily available to you. Ultimately, the beneficiaries can just bow out the home as well as let the lender foreclose or probably even get involved with the lending institution by Deeding the building back in lieu of repossession. As the home owner, you are responsible for your taxes, insurance policy, and also any other assessments on your residential property (i.e. HOA fees if any). If you transform the title into just your name before the funding starts, your brother will not be required to participate in therapy but there might be various other problems depending on how much cash you require to acquire him out. You need to know how these financings work, what your strategies are, and which alternatives will certainly best accomplish your objectives. Typically, many borrowers can profit when they do their study and also strategy meticulously.

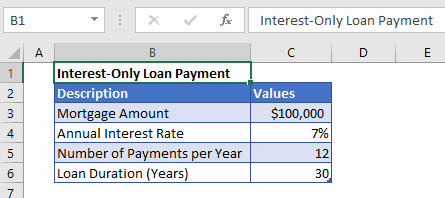

However I would motivate you to consider other alternatives if you do not think you would certainly ever before need more than just the $10,000. A reverse home loan is not the least pricey kind of funding readily available with the HUD insurance as well as if you just prepare to utilize this quantity, I do not believe it would deserve paying the expenses for the financing for this amount. The reverse home loan sets the amount of the benefit for which you qualify based on your age, your residential or commercial property value, program parameters and interest rates at the time. This is your Principal Limit on the finance, you do not request a collection financing amount based upon any type of various other factors. So as you extract funds and also as rate of interest accrues on the lending, the equilibrium expands as well as your equity placement in the residential property lessens.